How to Use Volume Weighted Average Price in Trading

Learn how to use the Volume Weighted Average Price indicator to spot trading opportunities, identify support levels, and gauge market sentiment. Ideal for enhancing your trading strategy.

The Volume Weighted Average Price (VWAP) is a valuable tool used by many traders, especially those focused on momentum trading in cryptocurrency markets. It offers an alternative to the Moving Average (MA) and helps measure an asset’s liquidity while also identifying support and resistance levels.

VWAP provides a clear trading benchmark through both price and volume. It gives traders a deeper look into market trends unlike basic price indicators. Volume often plays a big role in driving momentum which is why many chartists pay attention to it no matter what indicators they’re following.

Some traders even use volume-based tools like accumulation/distribution or on-balance volume (OBV) on their charts.

VWAP stands out because it combines price movement with volume directly on the price chart which offers a better sense of market dynamics.

What is Volume Weighted Average Price

VWAP shows the average price of a stock measured by the volume traded. It helps traders understand how much it would cost to buy an asset in small amounts over the trading day. Though VWAP can be applied to any time frame. It’s mostly used on intraday price charts.

How to Calculate Volume Weighted Average Price

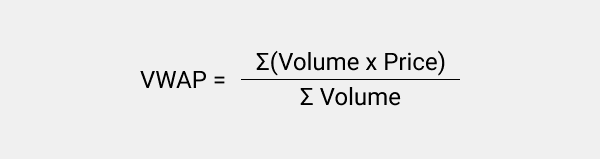

VWAP is calculated by multiplying each trade’s price by the number of shares in that trade. Then, the total is divided by the overall volume traded during the day. This gives a weighted average that reflects both the price and size of trades, offering a clearer picture of market behavior.

Volume Weighted Average Price Formula

Let’s look at the key parts of the formula:

Price is the average value of an asset over a certain period. There are three common types of average prices:

Median price: (High + Low) ÷ 2

Typical price: (High + Low + Close) ÷ 3

Weighted price: (High + Low + Open + Close) ÷ 4

Volume refers to the number of units traded during that period.

Total Volume is the sum of all units traded across the entire period.

This method allows traders to gauge market sentiment and make more informed decisions.

READ ALSO: Trade with Candlestick Patterns Like A Pro

READ ALSO: How to Choose the Right Broker for Trading

READ ALSO: How to Trade Options Volatility And Pricing

READ ALSO: How to Read Stock Charts for Beginners

How to Use VWAP

Let’s see how it can be used in trading.

Liquidity Indicator

VWAP considers both price and volume, making it a useful tool to gauge liquidity. When the VWAP aligns closely with the current price, it signals high liquidity or active trading. If the VWAP is far from the current price, liquidity tends to be lower.

Support and Resistance

VWAP also helps identify potential support and resistance levels. These are points where strong buying or selling pressure is likely, leading to price changes. Traders often watch for price movements above or below the VWAP. A price above suggests buying interest, while a price below indicates selling pressure.

Benefits of Using VWAP in Trading

There are several key advantages to incorporating VWAP into trading strategies:

Market Sentiment Gauge:

When the price is above VWAP, the market tends to be bullish. The price below suggests bearish conditions. This helps traders align their strategies with current trends.

Support and Resistance Role:

The VWAP line often acts as a magnet for price movement. A pullback to VWAP from above can signal a buying opportunity, while a rally toward it from below may suggest a selling point.

Spotting Reversals:

Large deviations from the VWAP can hint that a trend is losing momentum. This helps swing traders anticipate possible reversals and capitalize on short-term market movements.

Limitations of VWAP

Despite its usefulness, VWAP has certain limitations:

Lagging Indicator:

VWAP relies on past data, so it may not always reflect real-time market conditions. This can cause delays in decision-making.

Ignores Order Size:

VWAP treats multiple orders equally, even if they vary in size. This can lead to misleading signals, so traders should be cautious.

Best for Short-Term:

VWAP works better for short- to mid-term strategies. In long-term trading, it can generate inaccurate signals.

Multiple Versions:

Different variations of VWAP exist, and they may yield slightly different results. This can cause confusion for traders using it across multiple platforms.

VWAP Trading Strategies

Intraday Trading

VWAP can be useful for intraday trading to spot buying and selling opportunities. If an asset’s price is above VWAP, some traders might consider selling. When the price is below VWAP, it might be seen as a good time to buy.

Pairs Trading

This strategy involves taking a long position in a stock trading below VWAP, while shorting another stock trading above VWAP. The idea is that both stocks will eventually return to their respective VWAPs.

Trailing Stop

Here, traders set a trigger to buy or sell when the price moves a certain percentage above or below VWAP. For example, a 5% trailing stop might be set to manage risks effectively.

VWAP Pullback

This method assumes that after a big price move, the stock will likely retrace to the VWAP before continuing its trend. Traders first find a stock with a significant move, calculate its VWAP, and wait for the price to return to this level. Once it does, traders can enter a position, setting the stop loss just above or below the VWAP, based on the direction of the trade.

VWAP Bands

VWAP bands create a range around the VWAP line which is often set at two standard deviations. When the price reaches either the upper or lower band, traders can open a long or short position depending on the market’s direction. Stops should be placed just outside the bands to manage risks.

Conclusion:

The Volume Weighted Average Price indicator is a valuable tool for traders. It offers insights into liquidity, market sentiment, and price trends. Its ability to highlight support and resistance levels makes it useful for various strategies, especially in intraday trading.

However, like all indicators, it has limitations, and traders should use it alongside other tools for a clearer market perspective. It doesn’t matter if you’re identifying reversal points or setting trailing stops, VWAP can enhance your trading strategy when applied carefully.